Star Trek: Picard Season 1 Blu-ray review: “An ambitious, exciting series that takes Trek to another level” | critical popcorn

Amazon.com: Star Trek: Prodigy: Season 1: Episodes 1-10 : Brett Gray, Dee Bradley Baker, Angus Imrie, Ella Purnell, Rylee Alazraqui, Kate Mulgrew: Movies & TV

![Star Trek: Original Motion Picture Collection 1-6 [DVD]: Amazon.co.uk: William Shatner, Leonard Nimoy, DeForest Kelley, James Doohan, George Takei, Majel Barrett, Walter Koenig, Nichelle Nichols, Persis Khambatta, Stephen Collins, Grace Lee Whitney, Star Trek: Original Motion Picture Collection 1-6 [DVD]: Amazon.co.uk: William Shatner, Leonard Nimoy, DeForest Kelley, James Doohan, George Takei, Majel Barrett, Walter Koenig, Nichelle Nichols, Persis Khambatta, Stephen Collins, Grace Lee Whitney,](https://m.media-amazon.com/images/I/719ElfwtU3L._AC_UF1000,1000_QL80_.jpg)

Star Trek: Original Motion Picture Collection 1-6 [DVD]: Amazon.co.uk: William Shatner, Leonard Nimoy, DeForest Kelley, James Doohan, George Takei, Majel Barrett, Walter Koenig, Nichelle Nichols, Persis Khambatta, Stephen Collins, Grace Lee Whitney,

![Star Trek [DVD]: Amazon.co.uk: Chris Pine, Zachary Quinto, Eric Bana, Simon Pegg, Winona Ryder, Karl Urban, John Cho, Zoe Saldana, Bruce Greenwood, Ben Cross, Anton Yelchin, J.J. Abrams, Chris Pine, Zachary Quinto, Star Trek [DVD]: Amazon.co.uk: Chris Pine, Zachary Quinto, Eric Bana, Simon Pegg, Winona Ryder, Karl Urban, John Cho, Zoe Saldana, Bruce Greenwood, Ben Cross, Anton Yelchin, J.J. Abrams, Chris Pine, Zachary Quinto,](https://m.media-amazon.com/images/I/81hCWYkLTqL._AC_UF1000,1000_QL80_.jpg)

Star Trek [DVD]: Amazon.co.uk: Chris Pine, Zachary Quinto, Eric Bana, Simon Pegg, Winona Ryder, Karl Urban, John Cho, Zoe Saldana, Bruce Greenwood, Ben Cross, Anton Yelchin, J.J. Abrams, Chris Pine, Zachary Quinto,

![Star Trek: Strange New Worlds - Season One [DVD]: Amazon.co.uk: Melissa Navia, Anson Mount, Ethan Peck, Jess Bush, Christina Chong, Rebecca Romijn, Melissa Navia, Anson Mount: DVD & Blu-ray Star Trek: Strange New Worlds - Season One [DVD]: Amazon.co.uk: Melissa Navia, Anson Mount, Ethan Peck, Jess Bush, Christina Chong, Rebecca Romijn, Melissa Navia, Anson Mount: DVD & Blu-ray](https://m.media-amazon.com/images/I/8190fPpoHpL._AC_UF1000,1000_QL80_.jpg)

Star Trek: Strange New Worlds - Season One [DVD]: Amazon.co.uk: Melissa Navia, Anson Mount, Ethan Peck, Jess Bush, Christina Chong, Rebecca Romijn, Melissa Navia, Anson Mount: DVD & Blu-ray

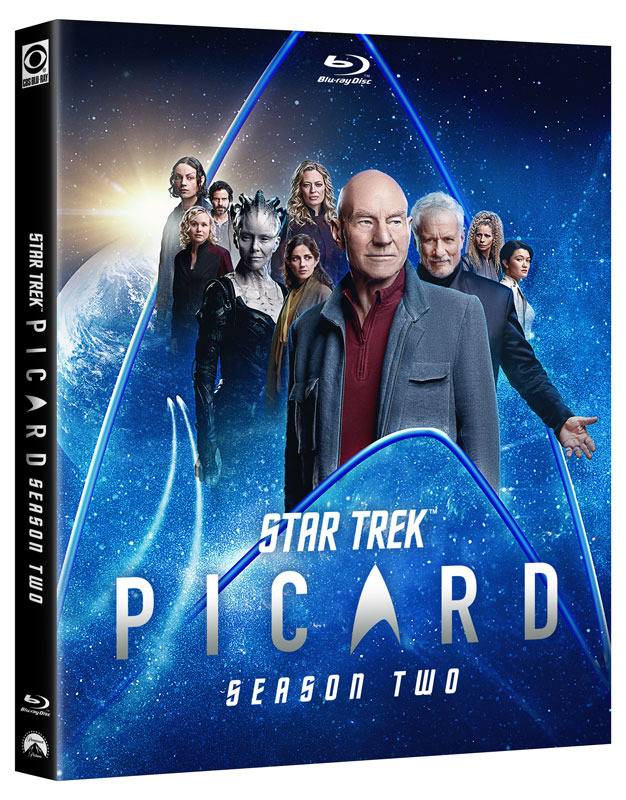

STAR TREK: DISCOVERY Season 4 Jumps to Blu-ray in December, New PICARD S2 Blu-ray Trailer, and PRODIGY S1 Blu-ray Too! • TrekCore.com

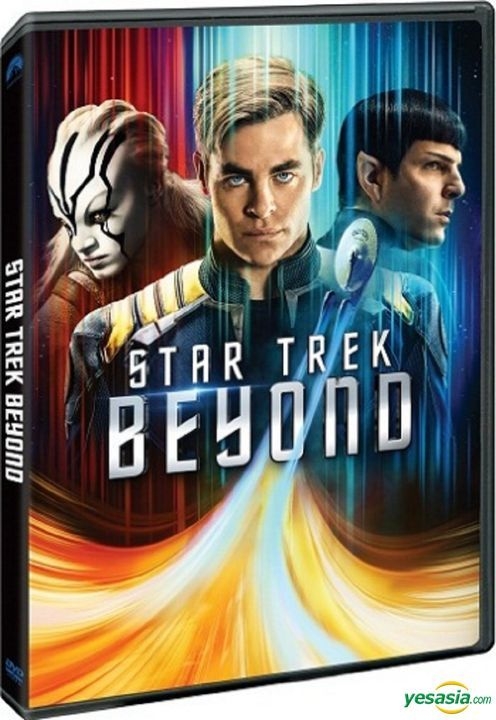

YESASIA: Star Trek Beyond (2016) (DVD) (Hong Kong Version) DVD - Zachary Quinto, Chris Pine, Intercontinental Video (HK) - Western / World Movies & Videos - Free Shipping - North America Site

Star Trek: Discovery Season 4 Arrives on Blu-ray, DVD, Limited Edition Steelbook & Digital on December 6

Star Trek Discovery: Guide to Seasons 1 and 2 Collector's Edition Book by Titan: 9781787734715 | PenguinRandomHouse.com: Books

![Star Trek: The Motion Picture - The Director's Edition [DVD]: Amazon.co.uk: William Shatner, Leonard Nimoy, DeForest Kelley, Stephen Collins, Persis Khambatta, Walter Koenig, James Doohan, George Takei, Nichelle Nichols, Mark Lenard, Majel Star Trek: The Motion Picture - The Director's Edition [DVD]: Amazon.co.uk: William Shatner, Leonard Nimoy, DeForest Kelley, Stephen Collins, Persis Khambatta, Walter Koenig, James Doohan, George Takei, Nichelle Nichols, Mark Lenard, Majel](https://m.media-amazon.com/images/I/5136VSMSJNL._AC_UF1000,1000_QL80_.jpg)

![Star Trek: Discovery - Season One (2018) [DVD / Box Set] - Planet of Entertainment Star Trek: Discovery - Season One (2018) [DVD / Box Set] - Planet of Entertainment](https://cdn11.bigcommerce.com/s-mmafe1g4n3/images/stencil/320x320/products/1753/1775/MM00251405__19042.1640169691.jpg?c=1)

![Star Trek: Nemesis (2002) [DVD] | Buy Online | Vinyl Records Direct Star Trek: Nemesis (2002) [DVD] | Buy Online | Vinyl Records Direct](https://vinylrecords-direct.com/wp-content/uploads/2023/02/Star-Trek-Nemesis-Front-600x647.jpg)